At The Morgan Law Group, our experienced homeowners’s insurance attorneys serve clients across Louisiana, Mississippi, California, Puerto Rico, and Florida. We understand that insurance companies often look for any oversight by homeowners to minimize or deny the total value of claims.

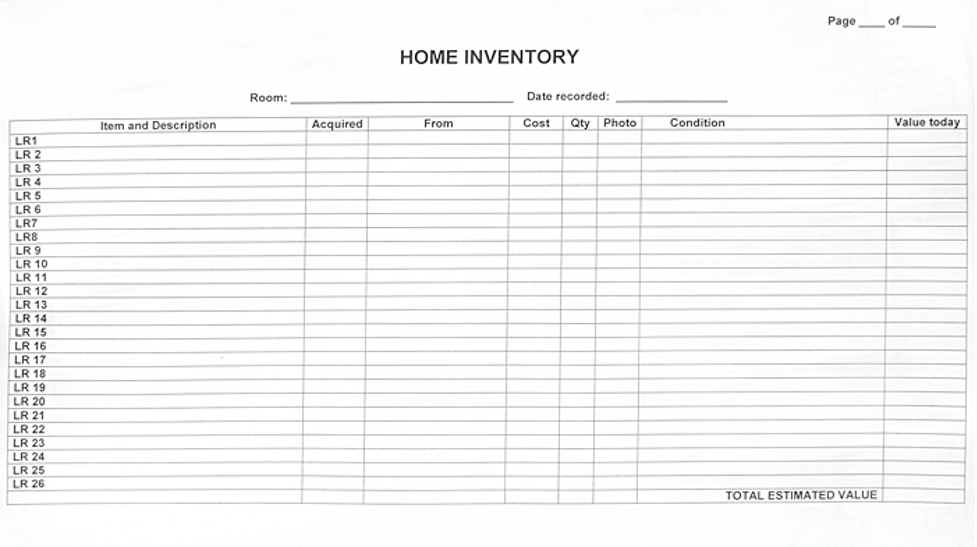

Experiencing property damage from hurricanes, floods, or fires can be distressing. However, an incomplete home inventory list, images, or proof of the contents damaged can lead insurance companies to deny coverage for those items. To prevent this, we explain that homeowners maintain an updated and complete home inventory list of their property and its contents.

Understanding why you should complete a home inventory list is more than just a record; it’s a strategy to streamline the home insurance claims process and ensure you receive the full compensation you deserve. A homeowner inventory list allows you to precisely identify and verify the value of lost items, significantly expediting and potentially increasing your claim’s payout.

Here’s how you can effectively manage your home inventory checklist to maximize your insurance claim benefits.

Importance of a Home Inventory List for Insurance Claims

A home inventory for insurance refers to a comprehensive list that homeowners compile detailing all the items and possessions within their home. Understanding why you should complete a home inventory helps ensure you can verify your losses if a covered event occurs. Documenting each item – along with its purchase date, serial number, and estimated value – serves as strong evidence for your claims and can speed up the settlement process.

Photographs and videos add valuable support to any written list. By compiling all details in one place, you reduce the possibility of overlooking damaged or lost items when requesting coverage. Some state insurance regulations also recommend maintaining receipts, warranty information, and appraisals to establish value and ownership.

Creating a complete home inventory strengthens your position when discussing compensation with insurance providers. It helps demonstrate that you have diligently tracked what belongs to you, making it more difficult for an insurer to refute or limit a claim. In cases where possessions are stolen or destroyed, having this comprehensive list greatly simplifies the process of seeking coverage for individual items.

Having clear awareness as to why you should have a complete home inventory list can provide clarity on how to prepare documentation that aligns with your insurance provisions with the help of your home insurance claim lawyers.

What Should Be Included in a Home Inventory?

A complete home inventory list is essential for protecting your assets and ensuring you receive the correct amount from your insurance in the event of a loss.

To create a comprehensive household inventory checklist, you should include the following information:

- Descriptions and images of all items: Document every item in your home with detailed descriptions and clear photographs. This visual record helps in verifying the existence and condition of your belongings.

- Purchase dates and the stores where they were purchased: Keeping track of when and where items were bought can be crucial in establishing their value and replacement cost.

- The makes, models, and serial numbers: For electronics, appliances, and other valuable items, noting the make, model, and serial number is vital for identification and replacement purposes.

- Estimated values of the items: Include the estimated value of each item to ensure you receive adequate compensation from your home insurance inventory.

- Receipts: Whenever possible, attach receipts or proof of purchase to substantiate claims and validate the item’s value.

By maintaining an up-to-date household inventory checklist, you can safeguard your assets and ensure you have the necessary documentation to support any insurance claims. Regularly updating your home inventory list will provide peace of mind and protection for your valuable possessions.

Tips When Creating an Inventory List of Home Contents

Creating a home inventory list can be done in various ways. You can opt for a written list, take pictures or videos, use a Word or Excel document, or utilize an app specifically designed for this purpose.

- Start with recent purchases: New items are easier to document and remember. This will also help you avoid forgetting about any purchases that may have slipped your mind.

- Use digital tools: Utilize apps or software designed for creating a home inventory checklist. These tools often come with features to store photos, receipts, and other details digitally.

The National Association of Insurance Commissioners has recently launched a home inventory app that simplifies the process. This app can scan barcodes for accuracy, categorize possessions, and store images effortlessly, making your home insurance inventory both accurate and organized.

- Keep copies off-site: Ensure your household inventory checklist is saved in a secure, remote location or cloud storage to prevent loss in case the physical copy is damaged. This will give you peace of mind knowing you can always access an up-to-date inventory of your belongings.

- Update regularly: As you acquire or dispose of items, keep your home inventory checklist current to reflect these changes accurately. Failing to do so could lead to discrepancies between your records and your actual possessions, which can be problematic for insurance claims or estate planning.

With these tips, homeowners can create a robust home inventory for insurance purposes, enhancing the efficiency and success of their homeowners’ insurance claims.

How to Know if You Have a Complete Home Inventory List

A well-documented list should capture every item of value in your home, from furniture and electronics to collectibles and clothing. One measure of completeness is whether each entry includes basic details – brand, model, purchase date, and estimated cost – along with any supporting information like receipts or appraisals. Many homeowners also document the location of each item within their residence.

Keeping multiple copies of your inventory – both digital and physical – is recommended. Reviewing your list each time you acquire a big-ticket purchase helps keep it accurate.

Understanding why you should complete a home inventory can guide you on how to make it as comprehensive as possible. If you have doubts about coverage for certain valuables, check your policy or speak to a professional. Confirming that your possessions are fully documented not only safeguards your potential claim but also helps establish peace of mind if unexpected losses occur.

Maximize Your Settlement with the Right Legal Representation

An itemized record of your belongings is the key reason why you should complete a home inventory. Insurers require clear documentation to verify each item’s value and replacement cost. Having complete home inventory not only helps you illustrate your losses but also bolsters your position if your provider disputes your insurance claim.

While an inventory list can help with your homeowner’s insurance claim, your provider is not simply going to write a blank check to reimburse you for your damages. An insurer’s main objective is to protect its bottom line, and they are not obligated to automatically cover every dollar you request. That is where knowledgeable insurance claim attorneys can be invaluable for protecting your right to fair compensation.

At The Morgan Law Group, our insurance attorneys are prepared to review your situation, evaluate policy language, and help you hold your insurer accountable for what you are owed. If you feel your home insurance claim has been unfairly minimized or denied, we are here to pursue the relief you deserve under your homeowner’s insurance policy.

Contact our experienced insurance claims attorneys to schedule a free consultation and learn how we can help you pursue the outcome you deserve from your insurance policy.